Power Price Scenarios until 2060

Individual power market reports for Europe

You receive more than just a power price scenario – you gain an Energy BrainReport. From A to Z, our energy market experts provide you with recognised energy market data including explanations you can grasp at a glance. Benefit from our fast and comprehensive service. You receive the figures that are relevant for you and, if required, we support you in processing them optimally.

Which investment is right for you? How is the power price and the market developing? Is this business model suitable? You will find the appropriate answers to these questions in our easy-to-follow power price scenario. If you wish, you can receive a quarterly report and thus keep an eye on the German and European electricity market.

We know how electricity is traded and the challenges of the energy markets. Leading European banks, investors and energy suppliers have long counted on our support to assess the economic viability of projects and plants. As an owner-managed company, we guarantee you well-founded, independent results.

Your benefits

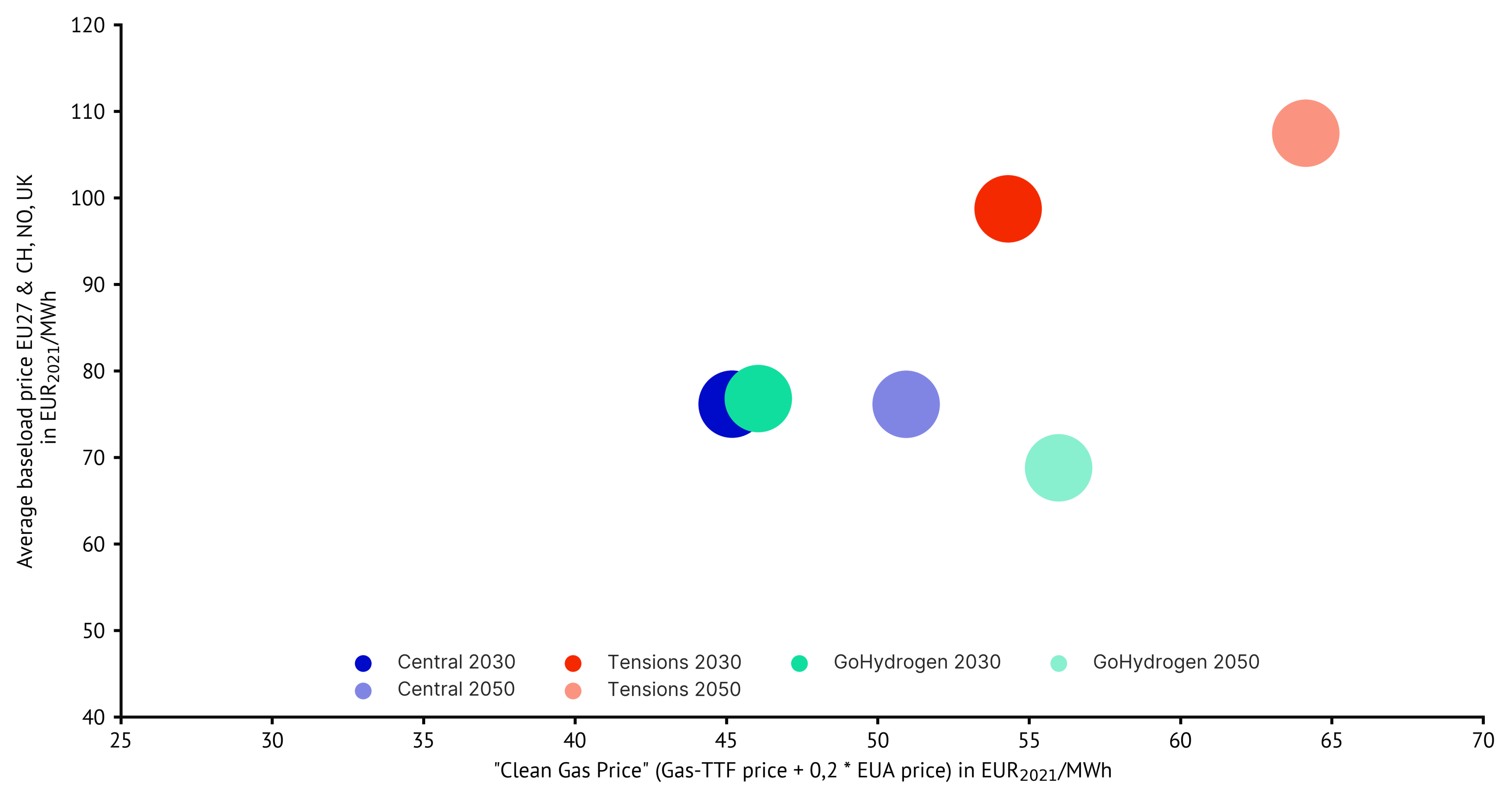

- Choose from up to three different scenarios that suit you best: Central, Tensions and GoHydrogen. The number and combination of scenarios is flexible.

- You get dependable power price scenarios for 18 European countries.

- Included are the baseload prices and capture prices for wind and PV until 2060, either in annual, monthly or hourly resolution.

- The PDF-documentation is easy to understand. You receive an Excel file with all results and assumptions that you can simply process further.

- Two hours of Q & A included because we want our scenarios to be plausible and comprehensible for you.

Would you like to purchase a power price scenario or do you have specific questions about the electricity market?

Michelle Wessner

Senior Sales Manager

How can power price scenarios support your business decisions?

In the energy markets, there are immense challenges for market participants, such as banks, investors, project developers or energy suppliers. These include evaluating long-term investments or optimising short- to medium-term procurement strategies. Well-founded, quantitative analyses of the European energy markets form the basis of a successful business concept.

With the help of our fundamental model Power2Sim, we calculate your specific power price scenario. The modelling incorporates current data from recognised sources, premises on energy policy developments and regulations, as well as our own expertise. Our scenarios show a wide range of possible development paths, for example conservative or progressive.

Our power price scenarios provide you with comprehensive and in-depth knowledge of future market and price developments. On this basis, you can make well-founded decisions for trading, procurement strategies, portfolio diversification, investment and financing decisions as well as the development of business models. No matter what, we stand by your side as a reliable partner.

"UmweltBank is a pioneer in financing PPA projects in Germany. The individual studies and expert knowledge of Energy Brainpool formed the basis for the creation of our groundbreaking concept."

"The constant change in the liberal and more and more decentralising energy market is challenging the municipal energy provider. This includes the ongoing recent evaluation of power plants and contracts. Energy Brainpool is supporting BS|ENERGY here with individual organised seminars, workshops and electricity price scenarios.“

"Together with our institutional investors, we, Encavis Asset Management AG, are driving forward the energy transition through electricity generation from solar and wind power. Our first priority is the competence of our actions, as well as the ability to manage entrepreneurial risks in a controlled manner. For years, Energy Brainpool's power price scenarios have helped us to evaluate future market revenues."

"With the Don Rodrigo project, Baywa r.e. realises the first market-based utility-scale PV power plant in Europe without any subsidies. For the evaluation of the power market revenues in the future, we use the power price scenarios of Energy Brainpool. In our view, these are particularly accurate and approved by our investors and banks alike."

Would you like to learn more about electricity market design?

Do you need sound advice on the energy industry?

The energy market model behind our scenarios.